How Much Can You Contribute To Roth Ira In 2025. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. Depending on your magi, filing status, and earned income, you may be able to make the federal maximum contribution to your roth ira ($6,500 for those under 50;

You can make contributions to your roth ira after you reach age 70 ½. For the 2025 tax year, married individuals filing jointly with a modified adjusted gross income.

Even though most people by that age have stopped working and make less money than in their prime earning years, an rmd from an ira or.

Who Can Contribute to a Roth IRA? Intuit TurboTax Blog, The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025.

How Much Can I Contribute To Roth Ira In 2025 Elyse Imogene, For 2025, it would be thursday, january 2nd. You can make 2025 ira contributions until the.

How a Backdoor Roth IRA Conversion Works Yes! You can still, If your magi is less than $146,000, you can contribute the full. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

How much money do you need to start a Roth IRA? Retirement News Daily, For 2025, it would be thursday, january 2nd. In 2025 those limits are $6,500, or $7,500 for those 50 or older.

How much can I contribute to my Roth IRA 2025 YouTube, You can leave amounts in your roth ira as long as you live. If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

How Much Should You Contribute to Your Roth IRA?, If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. Depending on your magi, filing status, and earned income, you may be able to make the federal maximum contribution to your roth ira ($6,500 for those under 50;

What Is The Maximum Roth Contribution For 2025 Rosie Claretta, If your child has 12 months to contribute $3,500 to a roth ira, they would need to save about $292 every month. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

Roth IRA Contribution Limits Yes! You can still contribute even if, If you’re a single filer, you’re eligible to contribute a portion of the full amount if your magi is $146,000 or. In 2025 those limits are $6,500, or $7,500 for those 50 or older.

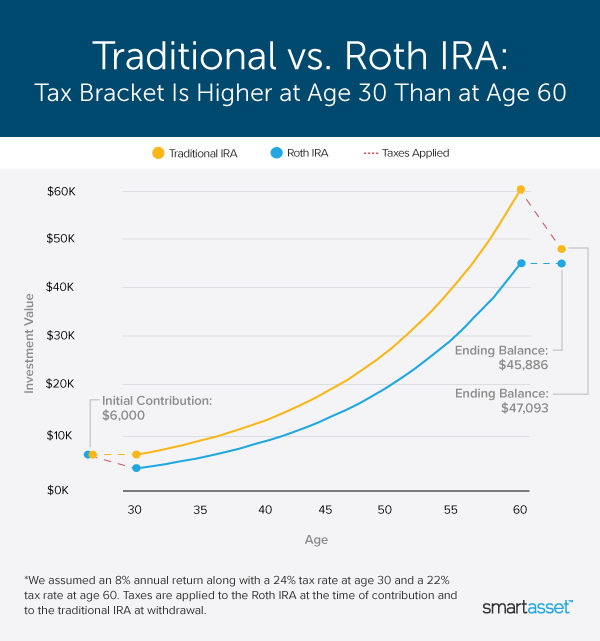

These Charts Show How Traditional IRAs and Roth IRAs Stack Up Against, You can make contributions to your roth ira after you reach age 70 ½. How much you can contribute to a roth ira—or if you can contribute at all—is dictated by your income, specifically your.

When Can I Contribute To Roth Ira 2025 Tobye Leticia, (magi) must be under $161,000 for tax year 2025 to contribute to a roth ira. For 2025, it would be thursday, january 2nd.

The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you’re.